How can we further assist you today?

Contact Us

Parcel Search

Information on this site was derived from data which was compiled by the Downers Grove Township Assessor’s office solely for the governmental purpose of property assessment. This information should not be relied upon by anyone as a determination of ownership of property or market value. No warranties, expressed or implied, are provided for the accuracy of data herein, its use, or its interpretation.

Although it is periodically updated, this information may not reflect the data currently on file in the Assessor’s office. The assessed values may NOT be certified values and therefore may be subject to change before being finalized for ad valorem assessment purposes.

Parcel data and values updated on April 29th, 2025.

The assessments displayed are 2024 Assessed Values, which include Supervisor of Assessments equalization factor of 1.0878.

Assessment Dates & Appeal Process

Assessment Dates

Appeal Process

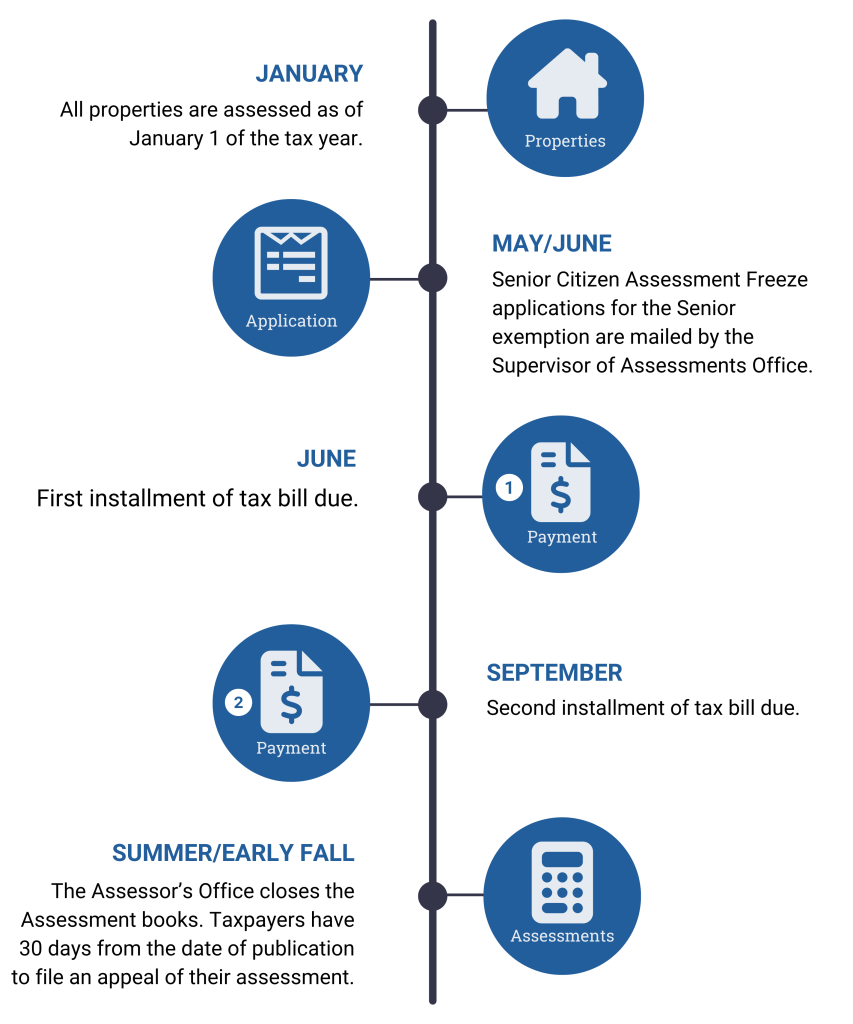

Downers Grove Township’s annual multiplier and changed assessments are published in our local newspapers in September or October. An exact date cannot be set due to the volume of assessments having to be reviewed in any particular year.

Prior to filing an assessment appeal contact the Assessor’s Office; many times problems can be solved at the Township and save you a trip to Wheaton. However, once the publication occurs, a property owner or agent has 30 days to file an appeal with the DuPage County Board of Review. Appeals must be postmarked on or before the deadline. Based on your preference, the Board of Review will schedule a hearing or an assessment review without you having to appear. You must submit your evidence to the Board of Review along with your Appeal form.

Please note: This is not an appeal or protest of your tax bill; it is about the assessed value of your property.

Please read the Appeal form carefully. Fill in the necessary information, submit any additional evidence, and mail directly to the Board of Review. This will assist the Board of Review in making a decision regarding the assessed value of your property.

If you have opted to have a hearing, the Board of Review will notify you by mail of the date and time. Hearings normally take place at 421 North County Farm Road, Wheaton, at the Board of Review/Supervisor of Assessments offices on the first floor. Due to the volume of hearings, rescheduling is not possible.

A Deputy Assessor from Downers Grove Township will also be present at the hearing. The Deputy will bring your Property Record Card file and evidence to support the assessment. Hearings are scheduled in 15 to 20 minute increments. Due to the volume of hearings and the time allotted, it is important to be concise and prepared to present your evidence.

Once heard, the Board of Review will determine the proper assessment of your property and will notify all parties by mail in March.

After receiving the Board of Review decision, if a property owner remains dissatisfied, you have 30 days to file an Appeal with the State of Illinois Property Tax Appeal Board. The forms and procedures are available on the PTAB website. Please note, due to cut backs at the State level the PTAB is experiencing a huge backlog of hearing case files. Your hearing may not take place for 2-3 years. During that time you must pay your property tax.

Residential Appeals

Normally residential appeals fall into two categories, a market value complaint or a uniformity problem. If you recently sold or purchased the property you are appealing, please submit a copy of your Closing Statement through our Contact Form. We will review the sale transaction and make any necessary adjustments to the assessment.

If there has been no sale of your property then you would want to gather evidence of recent sales of similar properties in your area and fill in the Residential Comparison Grid. To find sale information, a property owner can utilize the Assessor’s Parcel Search, contact the MLS or a realtor for sales information or get an appraisal of the property.

If you think the assessed value of your property is too high compared to other similar properties, list these comparable properties on the Residential Comparison Grid. Most of the information needed for the Grid can be obtained at our website.

Commercial / Industrial Appeals

The type of commercial-industrial property is important when submitting evidence for an appeal. If the property is income-producing, such as an apartment building, strip mall, office building, etc. an income and expense statement or vacancy statement should be submitted.

In some cases, it may be necessary to get an appraisal of the property. Forms for a Commercial-Industrial Appeal can be found at the Supervisor of Assessments website.

Property Assessment Process

Assessment Terms

View list of assessment terms.

How Property Value is Determined

Most property is assessed based on its market value. This is the price the property would bring on the open market, between a willing buyer and willing seller who are not under duress. Currently in the State of Illinois, other than Cook County and farm class properties, the statutory level of assessments is 33.333% of market value. This means that the property assessed value should be one third of its market value. There are three valuation methods available to arrive at this value:

Determining the replacement cost of property minus depreciation plus land value.

Using the comparison of recent sales prices of similar properties.

Calculating the present worth of property based on the income of income-producing property.

Farm land is assessed according to agricultural economic value, as certified by the Illinois Department of Revenue.

Sales Ratio Study

The three approaches to value are used in single property appraisal, however, considering the magnitude of the assessment jurisdiction, the State of Illinois uses a mass appraisal system. This is a statistical analysis of sales -vs- assessments that encompass a wider geographic area, such as an entire county, township or neighborhood. This analysis is called a Sales Ratio Study; it is used to calculate the ratio of the assessment to the sale. In Illinois this ratio is to be 33.333% of the market value of the property.

The compiled sales ratios from year to year give the State Department of Revenue an indication of the overall market trend as compared to the existing assessments in a jurisdiction. If the sale study ratios are predominately below 33.333% the assessments must be increased; if above 33.333% the assessments must be decreased. The State advises each County of the results of this annual study. In turn, the County compiles sales studies for each Township and advises the Township Assessor of the overall increase or decrease of the Township’s assessments.

In DuPage County, the Township Assessors take this one step further. The Assessor, using the same parameters, study individual neighborhoods, subdivisions, condominium complexes, etc., to attain more accurate market trend information for that particular area. This is done so one area’s market trend does not impact another and greater uniformity and accuracy is attained.

How It Works

When studying an assessment jurisdiction for market value purposes, be it a county, township or a neighborhood, all valid property sales during the last three years become a part of the study. A sales ratio study compares the sale to the prior year’s assessment; this is called the assessment to sale ratio or ratio. It indicates what percentage the assessed value is of the sale. According to Illinois state statute property shall be valued at 33-1/3% of fair cash value. After calculating all of the assessment to sales ratios in a neighborhood, they are sorted low to high. The mid-point ratio is called the median or median level of assessments for the jurisdiction.

If the median ratio of the area is under 33-1/3%, a multiplier is calculated which would bring the median ratio up to 33-1/3%. This multiplier is then applied to all assessments in the neighborhood. If the median ratio of the neighborhood is over 33-1/3% a multiplier is calculated to lower the median ratio to 33-1/3% and is applied to all assessments in the area.

Example: To determine the current year’s multiplier for an area the sales and sale ratios from prior three years are used:

| Sale Date | Assessment | Sale Amount | Ratio |

|---|---|---|---|

| 05/01/2005 | 192,820 | $656,740 | 0.2936 |

| 06/01/2006 | 190,310 | $625,000 | 0.3045 |

| 06/01/2005 | 197,910 | $649,100 | 0.3049 |

| 08/01/2007 | 244,560 | $774,660 | 0.3157 |

| 03/01/2007 | 194,260 | $596,620 | 0.3256 |

| 09/01/2005 | 166,660 | $497,000 | 0.3353 |

| 08/01/2007 | 195,300 | $563,310 | 0.3467 |

| 10/01/2006 | 185,760 | $529,000 | 0.3512 |

| 07/01/2005 | 196,540 | $539,900 | 0.3640 |

The median or middle ratio of the range is 32.56%. A multiplier of 1.0236 is needed to bring this area, as a whole, to 33-1/3%. A positive multiplier, more than 1.00, means that assessment must be increased.

If in another example the median ratio had been 35.27%, then a multiplier of .9450 (.3333 / .3527 = .9450) would be applied to all assessments in that area. A negative multiplier, less than 1.00, means that assessment must be lowered.

Some properties remain under assessed and some over assessed. During a general reassessment year the properties are reviewed to improve uniformity within the study area.

This mass appraisal system, which implements sales ratio studies, is used in the State of Illinois. Sales ratio studies such as this are calculated by the state for each county; by the county for each township and by the township for each of their neighborhood codes.

The DuPage County townships are the best assessed in the entire state. Our consistent goal is to strive for accuracy and greater uniformity with the use of advanced assessing techniques and technology.

Data / Reports / Neighborhood Map

Residential Assessment Neighborhood Map

An interactive map application that allows you to search by parcel and view assessment neighborhoods within Downers Grove Township.

Tentative New Construction Report

TENTATIVE 2024 New Construction Report

This report is subject to potential changes/modifications/equalization from DuPage Board of Review, Illinois Property Tax Appeal Board, Illinois Department of Revenue and/or other bodies having jurisdiction over assessments.

These figures include residential new construction but do not exclude HIE’s.

The County Clerk posts a final New Construction Report in the spring, titled “New Construction Per District Report (PDF)”, the report can be found here.

Parcel Data

The following downloads include ALL parcels and their related parcel information for each property class. The files are in Excel (.xlsx) format.

Parcel data and values updated on 04/29/24. The assessments displayed are the 2024 ASSESSED VALUES, which include Supervisor of Assessments equalization factor of 1.0878.

Note: Tax codes are not final until tax bills have been mailed.

Exemptions

Download application forms and documents from the Supervisor of Assessments website.

Illinois statutes provide for an exemption of up to 8,000 in equalized assessed value for the 2023 assessment year on homes occupied by the person legally responsible for the payment of real estate taxes. (This exemption was previously 6,000 equalized assessed value for the 2022 assessment year.)

Granted to owner-occupied property where an assessed improvement or addition has been constructed. It deducts the assessment attributable to the new improvement, up to 25,000, from the total assessment ($75,000 actual value). This four year exemption is automatic, an application is not required.

To qualify you must be 65 by December 31st of the assessment year for which the application is made, own and occupy the property, and be liable for the payment of real estate taxes on the property. The exemption reduces the equalized assessed value by 8,000 for the 2023 assessment year. (This exemption was previously 5,000 equalized assessed value for the 2022 assessment year.)

Proof of age and ownership is required with the application. An application is available at the Assessor’s Office or the Supervisor of Assessments Office.

Proof of Ownership – one of the following is required.

Note: These documents must be recorded.

- Deed in Trust

- Warranty Deed

- Trustee Deed

- Quit Claim Deed

- Release of Mortgage

- Release of Deed by Corporation

Note: These documents are not recorded.

- Contract Buying

- Title Insurance Policy – must include Schedule “A”

Note: These documents are not acceptable for Proof of Ownership.

- Affidavit of Sale

- Bill of Sale

- Closing Statement

- Mortgage Policy

- Receivers’ Deed

- Title Commitment

- Trust Deed

Proof of Age – one of the following is required

- State of Illinois Driver’s License

- Passport (current)

- Baptismal Certificate

- State of Illinois ID

- Birth Certificate

- Citizenship Papers – must include birth date

(Previously the Senior Citizen Assessment Freeze)

Who is eligible?

To qualify you must:

- establish age, ownership and residency, by applying for the Senior Homestead Exemption (which requires you to be age 65 by December 31st of the assessment year for which the application is made).

- have a total household income (before deductions) of $65,000 or less for the calendar year prior the application year.

- own and occupy the property on or before January 1st of the application year and prior base year.

- be liable for payment of real estate taxes on the property.

In some cases, the surviving spouse of an eligible senior citizen may qualify.

How do I apply?

Eligible senior taxpayers must complete an application/affidavit. This form must be signed. Income from all household members needs to be itemized and totaled. For the 2023 assessment year, taxes payable in 2024 eligibility, the senior taxpayer must complete an application showing 2022 household income.

All information acquired from the application is confidential and may be used only for official purposes. The deadline to file the application is October 1st. Each year, the Supervisor of Assessments will mail annual renewal applications to those senior taxpayers currently eligible for the assessment freeze. You may obtain an application by contacting our office at (630) 719-6630 or you may download the form.

Please bring the following for ALL household residents:

- US 1040

- Social Security 1099

- All other 1099’s

Statutory Citation: 35 ILCS 200/15-17

To qualify you must:

- be age 65 by June 1st of the year for which the application is made

- have a household income of less than $55,000

- own and occupy the property

- have lived in Illinois in a qualifying property at least 3 years

- be liable for payment of real estate taxes on the property

- have no delinquent real estate taxes

- have fire and casualty insurance on the property

- file application by March 1st, in the year the taxes are due

How do I apply?

Applications and guidelines are available from:

Gwen Henry

DuPage County Collector

421 N. County Farm Road

Wheaton, Illinois 60187

Phone (630) 407-5900

https://www.dupageco.org/treasurer/

What benefits does this program provide?

This program allows a qualifying senior to defer payment of real estate taxes and any special assessments on his or her residence. The State pays the real estate taxes and repayment plus interest of 6% annually is made when the senior sells the property or within a year of his or her passing.

To qualify you must:

- Must be an Illinois resident who has served as a member of the U.S. Armed Forces, Illinois National Guard, or U.S. Reserve Forces and returned from active duty in an armed conflict involving the armed forces of the U.S;

- Must own or lease and occupy the property as a primary residence and be liable for paying the property taxes.

Application Process

File a completed PTAX-341 application form with additional documentation demonstrating eligibility.

Proof of Ownership

Proof of Service

- If you were discharged from active duty service, you will need to provide the Department of Defense DD Form 214.

- If you are still on active duty after returning home, you will need to provide your military orders and travel voucher showing the date of your return.

- The documents must state that you are returning from an armed conflict involving the armed forces of the U.S. within the tax year that you are requesting this exemption.

Renewal Process

This program is only available for veterans for the year returning from the armed conflict therefore there is no renewal.

To qualify for this exemption:

- You must be disabled or become disabled during the assessment year (i.e., cannot participate in any “substantial gainful activity by reason of a medically determinable physical or mental impairment” which will result in the person’s death or that will last for at least 12 continuous months).

- The applicant must own or have a legal or equitable interest in the property, or a leasehold interest of a single-family residence. The applicant must occupy the property as your principal residence on January 1 of the assessment year, and is liable for the payment of the property taxes.

Application Process

File a completed PTAX-343 application form with additional documentation demonstrating eligibility.

Proof of Ownership

Proof of Disability

- A Class 2 Illinois Disabled Person Identification Card from the Illinois Secretary of State’s Office. Note: Class 2 or Class 2A qualifies for this exemption; a Class 1 or 1A does not qualify.

- Proof of Social Security Administration disability benefits. This proof includes an award letter, verification letter, or annual cost of living adjustment (COLA).

- Proof of Veterans Administration disability benefits. This proof includes an award letter of total (100%) disability, pension statement, or statement showing compensation rated at 100%.

- Proof of Railroad or Civil Service disability benefits is an award letter of total (100%) disability.

If you cannot provide proof of your disability listed in Items 1 through 4, then you will need to submit to the Illinois Department of Revenue (IDOR) a Form PTAX 343-A Physician’s Statement for Proof of Disability completed by a physician. You may also be required to be re-examined by an IDOR designated physician. Note: You will be responsible for any costs incurred for your examination by any physician.

Renewal Process

The Supervisor of Assessments to renew this exemption without the annually filed PTAX-343-R for taxable years 2022 through 2027. (County Board Resolution FI-R-0315-22 approved August 9, 2022)

The applicant must be an Illinois resident who is a veteran with at least 30 % service-related disability as certified by U.S. Department of Veterans Affairs. The home must be owner-occupied by the disabled veteran or the surviving unmarried spouse of the disabled veteran as of January 1st of eligibility year. Please note that you will not be eligible if you are claiming exemption under the Disabled Persons Homestead Exemption or the Disabled Veterans Homestead Exemption. Beginning for the 2024 assessment year (payable 2025), veterans of the United States Armed Forces during World War II are eligible (irrespective of disability status) to receive this exemption.

Application Process

Complete and file a PTAX-342 application form along with the required documentation with the Supervisor of Assessments.

Proof of Ownership

Proof of Service/Disability

- Form DD214 or a copy or Certification of Military Service Form with a Disability Certification Letter from the U.S. Department of Veterans Affairs for the current assessment year.

- Surviving un-remarried spouse will need to provide the disabled veteran’s marriage and death certificates.

Renewal Process

Complete and file a PTAX-342-R application form. A Disabled Veteran that is 100% Total and Permanently Disabled no longer needs to renew this exemption by filing a PTAX-342-R. Please check with the Supervisor of Assessments Office at (630) 407-5858 for more information.

The applicant must be a disabled veteran (or surviving un-remarried spouse) who has served in the Armed Forces of the United States and who has acquired, in connection with that service, a disability of such a nature that the Federal Government has authorized payment for purchase or construction of specially adapted housing as set forth in the U.S. Code Title 38, Chapter 21.

The applicant’s home must be owner-occupied by the disabled veteran, the disabled veteran’s spouse, or the surviving un-remarried spouse of the disabled veteran as of January 1st of eligibility year.

Application Process

Upon notification by the Illinois Department of Veterans Affairs of eligibility, the exemption will be automatically processed on behalf of eligible individual.

Renewal Process

The exemption renewal is initiated when the Illinois Department of Veterans Affairs notifies the Supervisor of Assessments of eligibility and does not require any action by the recipient.

Frequently Asked Questions

- All fees are subject to change without notice

- Credit cards not accepted

- We only accept cash or check, make checks payable to Downers Grove Township Assessor’s Office

- Returned check fee $25.00

- There is no cost for the first 50 pages, thereafter each page is $0.15

- Plat Pages – $2.00 per page

- Mailing Fee – $3.00

The assessed value determines your portion of the overall tax burden. The tax burden is the individual taxing bodies request for money, there is a list on your tax bill of all the taxing bodies that provide services to your particular area. When these taxing districts levy for more than the prior year the overall increase is reflected in your tax bill.

Your tax bill will stay flat or decrease when the taxing bodies request the same amount or less than they did in the prior years.

Due to legislative action, in 1991 the Property Tax Extension Limitation Law (PTELL) became law. The Tax Cap, as it is known, states property tax extensions (levies) are limited to a 5% increase or the increase in the national Consumer Price Index (CPI) which ever is the least amount. The limitation can be increased for a taxing body but only with voter approval.

The Illinois Department of Revenue and State Statute sets forth laws and guidelines that an Assessor must follow to assess property. Most important is to assess at a third of market value. However, 33 1/3% of market value is based on the prior three years of sales and assessment data.

Other Statutes in the Illinois Property Tax Code

(35 ILCS 200/1 50)

Sec. 1 50. Fair cash value. The amount for which a property can be sold, in the due course of business and trade, not under duress, between a willing buyer and a willing seller.

(35 ILCS 200/1 23)

Sec. 1 23. Compulsory sale. “Compulsory sale” means (i) the sale of real estate for less than the amount owed to the mortgage lender or mortgagor, if the lender or mortgagor has agreed to the sale, commonly referred to as a “short sale” and (ii) the first sale of real estate owned by a financial institution as a result of a judgment of foreclosure, transfer pursuant to a deed in lieu of foreclosure, or consent judgment, occurring after the foreclosure proceeding is complete.

(35 ILCS 200/9 180)

Sec. 9 180. Pro rata valuations; improvements or removal of improvements. The owner of property on January 1 also shall be liable, on a proportionate basis, for the increased taxes occasioned by the construction of new or added buildings, structures or other improvements on the property from the date when the occupancy permit was issued or from the date the new or added improvement was inhabitable and fit for occupancy or for intended customary use to December 31 of that year…

When, during the previous calendar year, any buildings, structures or other improvements on the property were destroyed and rendered uninhabitable or otherwise unfit for occupancy or for customary use by accidental means (excluding destruction resulting from the willful misconduct of the owner of such property), the owner of the property on January 1 shall be entitled, on a proportionate basis, to a diminution of assessed valuation for such period during which the improvements were uninhabitable or unfit for occupancy or for customary use….

(35 ILCS 200/9 205)

Sec. 9 205. Equalization. When deemed necessary to equalize assessments between or within townships or between classes of property, or when deemed necessary to raise or lower assessments within a county or any part thereof to the level prescribed by law, changes in individual assessments may be made by a township assessor or chief county assessment officer, by application of a percentage increase or decrease to each assessment.

(35 ILCS 200/9 210)

Sec. 9 210. Equalization by chief county assessment officer; counties of less than 3,000,000. The chief county assessment officer in a county with less than 3,000,000 inhabitants shall act as an equalizing authority for each county in which he or she serves. The officer shall examine the assessments in the county and shall equalize the assessments by increasing or reducing the entire assessment of property in the county or any area therein or of any class of property, so that the assessments will be at 33 1/3% of fair cash value. … For each township or assessment district in the county, the supervisor of assessments shall annually determine the percentage relationship between the estimated 33 1/3% of the fair cash value of the property and the assessed valuations at which the property is listed for each township, multi township or assessment district. …With the ratio determined for each township or assessment district, the supervisor of assessments shall then determine the percentage to be added to or deducted from the aggregate assessments in each township or assessment district, in order to produce a ratio of assessed value to fair cash value of 33 1/3%. That percentage shall be issued as an equalization factor for each township or assessment district within each county served by the chief county assessment officer. The assessment officer shall then change the assessment of each parcel of property by application of the equalization factor.

(35 ILCS 200/12 10)

Sec. 12 10. Publication of assessments; counties of less than 3,000,000. In counties with less than 3,000,000 inhabitants, as soon as the chief county assessment officer has completed the assessment in the county or in the assessment district, he or she shall, in each year of a general assessment, publish for the county or assessment district a complete list of the assessment, by townships if so organized. In years other than years of a general assessment, the chief county assessment officer shall publish a list of property for which assessments have been added or changed since the preceding assessment, together with the amounts of the assessments, except that publication of individual assessment changes shall not be required if the changes result from equalization by the supervisor of assessments under Section 9 210, or Section 10 200, in which case the list shall include a general statement indicating that assessments have been changed because of the application of an equalization factor and shall set forth the percentage of increase or decrease represented by the factor. The publication shall be made on or before December 31 of that year, and shall be printed in some public newspaper or newspapers published in the county. In every township or assessment district in which there is published one or more newspapers of general circulation, the list of that township shall be published in one of the newspapers.

Once every four years, by law, the Assessor must review and reassess all property in the jurisdiction. In the middle three years, normally a multiplier is applied to all parcels within a Township. It’s in the fourth year, the General Reassessment year, that adjustments are made to reflect the market activity in smaller specific areas and neighborhoods within a Township.

Also, in a General Reassessment year notices are mailed to each property owner and all assessments are published in local newspapers. The newspaper your parcel is listed in is printed on your assessment notice.

Portions of the entire publication are printed in Hinsdale, Clarendon Hills & Weekly Doings and the Downers Grove, Westmont and Hinsdale Suburban Life Newspapers. All of these procedures are in accordance with Illinois State Statute.

This does NOT mean your taxes will increase by the same percentage. The amount of the overall tax collection is determined by the taxing bodies…schools, government, parks, fire districts, etc. Your portion of that tax collection is dictated by the assessed value of your property.

Unfortunately, we cannot tell you what your tax bill amount will be at this time because the taxing body’s request for money must be sent to the County Clerk and the processing of that information does not take place until the following spring.

The Assessor’s Office is sent copies of building permits from DuPage County and the villages within the Township boundaries. Once the permit is received a Deputy Assessor Field Person inspects each site, measures the structure, and lists its amenities for assessment purposes.

Home Improvement Exemption is an exemption which is automatically granted when you have made an improvement to your property, such as, a room addition, new garage or fireplace, finishing a basement, or have built a new deck or porch. The assessment increase attributable only to the new improvement is exempt for four years, with a maximum of 25,000 in assessed value. If the assessment increase exceeds 25,000 the balance of the assessment is subject to taxation.

For example, if you have built a deck and it is assessed for 4,500, for the next four years the property assessed value will be reduced by 4,500. However, if you have built a room addition and it’s assessment is 37,000, for the next four years the property assessment will be reduced by only 25,000, the maximum exemption.

Once the new construction is complete a notice of assessment change will be sent. It will reflect the total assessment, including the full assessed value of the new improvement. Prior to calculating the tax bill, however, the exemption amount is applied, along with any other exemptions that apply.

New siding, windows, roofing, replacement of a furnace or plumbing fixtures, and landscaping, for example, are considered normal maintenance and do not change the overall assessment. These types of repairs or replacements are not eligible for the Home Improvement Exemption since they do not increase the assessment.

Please check the Township boundaries on the map. Properties west of Woodward Avenue are assessed by Lisle Township, (630) 968-1183. Properties north of 39th Street are assessed by York Township, (630) 627-3354.

Tax bill payment questions should be directed to the DuPage County Treasurer’s office at (630) 407-5900. The Assessors Office cannot accept tax bill payment. They can be paid at the DuPage County Treasurers office at 421 North County Farm Road, Wheaton, IL 60187. Also, there are several local banks that accept payment. Call the County Treasurer for more information.

You may call the DuPage County Clerk’s office at (630) 407-5500. Depending on your questions they may suggest you contact the taxing body directly.

Special service areas, to pay for sewers, water, etc. in a specific area, are handled by the DuPage County Clerk at (630) 407-5500.

Even though properties may be assessed the same, exemptions specific to that property can cause a difference in the tax bill amount. Prior to the tax bill calculation the assessment is reduced by the amount of exemptions the person and/or property qualifies for that year. The exemptions are as follows:

The residential homestead exemption of up to 8,000, the senior exemption of 8,000; the home improvement exemption which reduces the assessed value up to 25,000, based on assessment attributable to the new improvement; and the senior freeze, which freezes the assessment at the prior year’s value.

Tax bills also vary due to differing tax rates. There are over 200 different tax rates in Downers Grove Township alone, due to the number of taxing districts serving the citizens in a given area.

Tax bill calculation: Equalized Assessed Value – Exemptions x Tax Rate = Tax Bill

Assessment Terms

Is the length of time improvements on the land have been in existence.

Is the estimated age for appraisal purposes, based on comparison with other structures of the same type, depending on the actual condition of the property.

Means “according to value”.

An opinion of the value of property, supported by evidence.

The official act of discovering, listing and appraising property for ad valorem tax purposes.

A unit which measures uniformity. The average absolute deviation from the mean or median divided by the mean or median.

A property which has a similar location and is similar in construction and amenities.

Whereby the appraiser evaluates and selects from among two or more alternative conclusions to reach a single answer for a final value estimate.

An appraisal method in which the value of the land considered as vacant is added to the depreciated value of the improvements to obtain the estimated market value of the whole property.

A form which lists the subject and comparable property and their amenities for comparison purposes.

Is a loss in property value from any cause.

An estimate of depreciation, based on actual inspection of the property.

Wear and tear.

From conditions within the structure.

From conditions outside the property.

A mass appraisal method whereby the last three years of sales in a given jurisdiction or neighborhood code are then studied as to how the sales correspond to the assessments (a sales ratio study). If, on an overall basis the median level of assessment is less than 33.333%, a multiplier is applied to all properties to increase the assessments; likewise, if the median level of assessments is above 33.333%, then a multiplier is applied to all properties to decrease assessments.

A benefit, by law, which reduces the assessed value of a property.

A strip of land one foot wide fronting on a street and running the entire depth of the lot.

A review and reassessment of all properties every four years by the Assessor. Individual assessment notices are mailed to each property owner, along with a publication of all assessments in the newspaper. During the ensuing three years, the Assessor, the Supervisor of Assessments (County Chief Assessment Officer), and the Board of Review has the authority, by statute, to equalize properties in the Township to arrive at a level of one third of market value.

Sale price divided by the gross income expressed in a percentage or multiplier. The relationship between the gross income and value.

The value which will generate the highest net return to a property over a period of time. The use must be legal and reasonable, profitable and probable.

The amount a building value is increased attributed to the addition of a qualifying improvement.

The 25,000 assessed value maximum per assessment year that will be credited on the tax bill.

A building or structure.

An appraisal method used to estimate the market value of a property based on the income it produces or is capable of producing. Also known as the Capitalization Approach.

A statement which serves to identify the location and boundaries of a parcel of land.

The amount of funds required from the property tax system to support a taxing body.

An appraisal method in which the appraiser searches the market for selling prices of similar properties, and then, by the process of comparison and adjustments, estimates the value of the subject property. Also known as the Sales Approach or Comparison Approach.

The most probable price expressed in terms of money the property would bring if exposed for sale in the open market in an arms length transaction between a willing seller and a willing buyer, both of whom are knowledgeable concerning all the uses to which it is adapted, and for which it is capable of being used. Implicit within the definition is: (1) that the value is the most probable price, not the highest not the lowest, not the average price; (2) the value is expressed in terms of money and a reasonable time for exposure to the market; (3) it requires an arms length transaction in the open market; (4) both buyer and seller are informed of the uses of the property; (5) it requires a willing buyer and a willing seller with no advantage being taken by either; and (6) it recognizes present use as well as potential use of the property.

Process of valuing a universe of properties by employing a common reference for data in allowing for statistical testing. The State of Illinois is a mass appraisal state.

The middle number of a list of numbers.

In Illinois the statutory median level of assessment is 33.333%.

The environment of a subject property that has a direct and immediate impact on it’s value. The boundaries being either natural (rivers, lakes, hills, etc.), man-made (streets, highways, railroad tracks, etc.) and political (city limits, school or zoning districts, etc.).

An internal code give to a particular neighborhood or area. This groups specific properties for market and sales ratio studies and prevents sales and data outside of the code to impact the study.

A 10 digit number used to identify a specific property or parcel of land.

A document which lists amenities of a parcel, which may include a drawing or photo of the property.

A method of estimating the construction cost of a structure by making a detailed estimate of the quantities and cost of materials and labor plus addition of overhead and profit.

Real estate encompasses two categories: land and improvements. Land can be defined as the surface of the earth together with everything under its boundaries and everything over it, expanding indefinitely into space. Improvements consist of structures, fencing, paving, landscaping; any item that is considered immovable and (permanently) affixed to the land is considered real estate.

The sum of the tangible and intangible rights in the land and improvements. It refers to the interest, benefits, and the rights inherent in ownership of physical real estate.

is the cost of reproducing an exact replica on the basis of current prices with similar materials.

Is the cost of reproducing, at current cost, a similar property which is equally desirable and having a utility equivalent to the one under appraisal.

The relationship of the assessment to sale price expressed as a percentage. In Illinois the median ratio is 33.333%.

A mathematical study of the ratios in a given area or study sample to find the sales trend, median level and coefficient of dispersion. A sales ratio study will indicate if the assessments in the area or study sample must be adjusted to reach the legal level of 33.333%.

Is the cost obtained by dividing the total construction cost of the building by the total square foot area as measured from the exterior face of the outer walls (ground area of the building) or by the square foot of each floor in the structure measured from the exterior face of the outer walls.

More appropriately, the Levy Cap is designed to slow the rate of levy increases. This is a cap on local taxing bodies spending, not on real estate assessment. Levies, however, may increase more that 5% if: 1) bonds are sold with or without a referendum; 2) the municipality is a home rule community; 3) reassessments are necessary to keep properties at one third of market value. This is not an assessment cap.